Official Business News of Key West/Florida Keys & the rest of the Civilized Worldä www.FloridaKeys.US

Official Business News of Key West/Florida Keys & the rest of the Civilized Worldä

Now on lecture circuit making $millions? Now on lecture circuit making $millions?Current 'Top Dog': rates may have to rise ?! but? he 'Drops New Currency from Helicopters'?

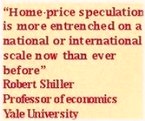

*-- "In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. ... This is the shabby secret of the welfare statists' tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard." - Alan Greenspan

- Chinese proverb

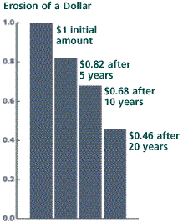

As The Money Flows: With nothing new to tell and everything old to sell, the energy domination is poised for a field day. The oil barons are buying drinks at the saloon, while the nuclear power fiends are gearing up for Star Wars The Next Chapter... Once again! Homo Sapiens Erectus is crawling on all fours across the road confusing the direction to progress.

Chief Investment Strategist --- Sensei

Press releases contain statements of a forward-looking nature relating to future events or future financial results. Investors are cautioned that

such statements are only predictions and actual events or results may differ materially. In evaluating such statements, investors should specifically

consider various factors, which could cause actual events or results to differ materially from those indicated from such forward-looking statements.

The Company undertakes no obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date hereofor to refledt the occurrence of unanticipated events.

Disclaimer: This section is for displaying opinion only. Any news or links are the subject matter of those sources and not necessarily the opinion of the author. The financial information is opinion unless otherwise stated. All information presented in this section is not investing advice nor recommendations for investing decisions. If you wish to use this information for your own personal investing decisions, you do so at your own risk. The author of this section advises you seek a professional financial adviser for all matters regarding personal investments. The author shall not be held responsible for the actions of others nor decisions made based on the information presented within these pages. -StockPie.com (StockPie.com is subscription Econ-Newsletter)

Hulacaneä Martini: 2oz of Rum, Sugarcane stalk, 2oz Sweet & Sour mix, Secret ingredient, 1oz pineapple juice,

Shake in a circular motion over ice and strain into a chilled martini glass, garinish with wedge of lime.

_______________________________________________________

|

STOCKPIE.COM supports : Help Stop Activities that endanger our Systems-------

What Is Money Laundering?

Money laundering is the process by which criminals attempt to conceal the true origin and ownership of the proceeds of their criminal activities. If undertaken successfully, it also allows them to maintain control over thoses proceeds and, ultimately, to provide a legitimate cover for their source of income.

The Need To Combat Money Laundering

In recent years there has been a growing recognition that it is essential to the fight against crime, that criminals be prevented from legitimising the proceeds of their criminal activities by converting funds from "dirty" to "clean".

The ability to launder the proceeds of criminal activity through the financial system is vital to the success of criminal operations. Those involved need to exploit the facilities of the world's financial instutions if they are to benefit from the proceeds of their activities. The increased integration of the world's financial systems, and the removal of barriers to the free movement of capital, have served to make the process by which proceeds of crime can be laundered much easier and at the same time, making the tracing process more complicated. Consequently, The World's Nations have an important role to play incombating money laundering by virtue of being a major international business and financial center.

Stages of Money Laundering

There is no one single method of laundering money. Methods can range from the purchase and resale of a luxury item (e.g., cars or jewelry) to passing money through a complex international web of legitimate businnesses, "shell" companies and other corporate vehicles. Initially, however, in the case of drug trafficking and some other serious crimes, such as robbery, the proceeds usually take the form of cash that needs to enter the financial system by some means.

Despite the variety of methods employed, the laundering process takes place in three stages, which may comprise numerous transactions that could alert a financial institution to criminal activity. The three stages of money laundering are:

a). Placement - the physical disposal of cash proceeds derived from illegal activity;

b). Layering - separating illicit proceeds from their source by creating complex layers of financial transactions designed to disguise the audit trail and provide anonymity; and

c). Integration - the provision of apparent legitimacy to criminally derived wealth. If the layering process has succeeded, integration schemes place the laundered proceeds back into the economy in such a way that they re-enter the financial system appearing as normal into the economy in such a way that they re-enter the financial system appearing as normal business funds.

The three basic steps may occur as separate and distinct phases, they may occur simultaneously or, more commonly, they may overlap. How the basic steps are used depends on the available laundering mechanisms and the requirements of the criminal organisations.

The Global Fight Against Money laundering

The Financial Action Task Force(FATF)

The Financial Action Task Force was founded by the Governments of the G7 leading industrialised nations in 1989. The FATF is the main international body for addressing money laundering. A list of its member countries can be found at the FATF website http://www.oecd.org/fatf/"www.oecd.org/fatf. The FATF is an inter-governmental body that develops and promotes policies, both nationally and internationally, to combat money laundering. As a "policy making body" therefore, its primary goal is to generate the political will necessary for bringin about national legislative and regulatory reforms in this area.

The FATF have put together 40 Recommendations [1] on tackling money laundering. The 40 Recommendations provide the scope for cooperation at the international level in the global fight against money laundering.

The Forty Recommendations set out the framework for anti-money laundering efforts and are designed for universal application. They provide a complete set of counter-measures against money laundering covering the criminal justice system and law enforcement, the financial system and its regulation, and international co-operation.

Some of the basic obligations contained in the Recommendations are:

The FATF has also promoted the concept of regional organisations along the lines of its own structure, whose goals are to raise awareness of money laundering and introduce regional evaluation structure, whose goals are to raise awareness of money laundering and introduce regional evaluation programmes to monitor implementation of the 40 Recommendations, amongst other things.

The Caribbean Financial Action Task Force (CFATF)

Within Caribbean, the Caribbean Financial Action Task Force was established as part of the efforts of the FATF to set up regional style bodies patterned after the FATF. The CFATF came into existence as a result of three regional meetings of Governments. The first occurred in June 1990 in Aruba at a conference attended by representatives of fifteen states, plus the five "donor' countries of the FATF which have an affiliation with the region [2]. The Aruba meeting reviewed the 40 recommendations of the FATF and produced twenty-one recommendations [3]. These complement the original FATF recommendations and have particular applicability within this region.

The second regional meeting took place in Kingston, Jamaica, in June 1992, and was attended by the representatives of the states and territories which had attended the Aruba meeting. This meeting addressed the main areas of focus: legal; financial; political; and technical assistance. Detailed recommendations were prepared, and later presented to a Ministerial meeting which was convened in Kingston in Novemebr 1992. The Ministerial Meeting produced an accord embodied in the "Kingston Declaration on Money Laundering". This Declaration endorses the implementation of the 1988 UN "Vienna" Convention, the OAS Model Regulations and the FATF and the CFATF recommendations. The Kingston Declaration also called for the establishment of a Regional Secretariat to co-ordinate the process of implementation within member states.

In November 1993 a Steering Group meeting that agreed on the arrangements for the creation of the Secretariat was convened in Port of Spain. The Secretariat was established during early 1994, in Trinidad and Tobago, and funded by the FATF donor countries. The Chair of CFATF is rotated annually amongst its members.

The members of the CFATF are: Anguilla, Antigua and Barbuda, Aruba, The Bahamas, Barbados, Belize, Bermuda, British Virgin Islands, Cayman islands, Costa Rica, Dominican Republic, Dominica, Grenada, Jamaica, Monserrat, Netherlands Antilles, Nicaragua, panama, St. Kitts and Nevis, St. Lucia, St. Vincent and the Grenadines, Suriname, Trinidad and Tobago, Turks and Caicos Islands and Venezuela.

______________________________________________________________

STOCKPIE.com "SETTING THE SUN"©

Disclaimer

The views contained here may not represent the views of StockPie.com / StockPie.com Research, its affiliates or advertisers. StockPie.com Research makes no representation, warranty or guarantee as to the accuracy or completeness of the information (including news, editorials, prices, statistics, analyses and the like) provided through its service.

Stockpie.com / StockPie.com Research

Stockpie is a protected Trademark of STOCKPIE and Key West Register Corp.Press releases contain statements of a forward-looking nature relating to future events or future financial results. Investors are cautioned that such statements are only predictions and actual events or results may differ materially. In evaluating such statements, investors should specifically consider various factors, which could cause actual events or results to differ materially from those indicated from such forward-looking statements. The Company undertakes no obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date hereofor to refledt the occurrence of unanticipated events.and Key West Register assumes no responsibility for any losses, damages or liability whatsoever suffered or incurred by any person, resulting from or attributable to the use of the information published on this site. User is using this information at his/her sole risk.

© COPYRIGHT 2026STOCKPIE.COM

|

"Irrational Markets Can Outlast Individual Solvency"... T. E. Kotas/Stockpie.com©

"Irrational Markets Can Outlast Individual Solvency"... T. E. Kotas/Stockpie.com©

Later - See You On Duval Street"©

Later - See You On Duval Street"©  "Find the trend whose premise is false and bet against it." - George Soros

"Find the trend whose premise is false and bet against it." - George Soros

a few years ago

a few years ago

"Key West Institute's Cuba Research Symposium"

"Key West Institute's Cuba Research Symposium"